- #CALIFORNIA TAX BRACKETS 2020 FULL#

- #CALIFORNIA TAX BRACKETS 2020 SOFTWARE#

- #CALIFORNIA TAX BRACKETS 2020 SERIES#

- #CALIFORNIA TAX BRACKETS 2020 FREE#

Learn how we can tackle your industry demands together. You face specific challenges that require solutions based on experience.

Small, midsized or large, your business has unique needs, from technology to support and everything in between. See how we help organizations like yours with a wider range of payroll and HR options than any other provider.

#CALIFORNIA TAX BRACKETS 2020 SOFTWARE#

Marketplace OverviewĬomprehensive payroll and HR software solutions. Our online store for HR apps and more for customers, partners and developers. Quickly connect ADP solutions to popular software, ERPs and other HR systems. Simplify and unify your HCM compliance processes. HR Services Overviewįocus on what matters most by outsourcing payroll and HR tasks, or join our PEO. Benefits Overviewįrom best practices to advice and HR consulting. Talent OverviewĮmployee benefits, flexible administration, business insurance, and retirement plans. For advanced capabilities, Workforce Management adds optimized scheduling, labor forecasting/budgeting, attendance policy, leave case management and more.įrom recruitment to retirement, getting the very best out of your people. Manage labor costs and compliance with easy Time & Attendance tools.

#CALIFORNIA TAX BRACKETS 2020 FULL#

"The more you make, the higher your tax rate is.Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries.įast, easy, accurate payroll and tax, so you save time and money.

#CALIFORNIA TAX BRACKETS 2020 FREE#

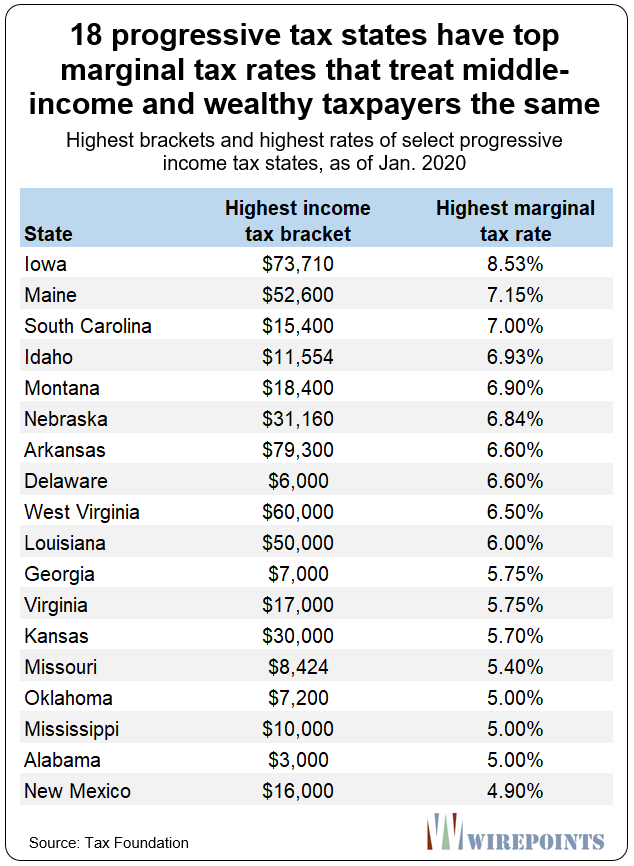

"Progressive tax systems are more common and apply a higher tax rate to higher earners," says Tyler Davis, a CPA with Simplify LLC, which provides free resources for small business owners.

#CALIFORNIA TAX BRACKETS 2020 SERIES#

Graduated, or progressive, tax rates use a series of income thresholds called brackets to assess taxes. Note: The deduction for state and local taxes is commonly referred to as SALT. The Tax Cuts and Jobs Act of 2017 set a deduction limit of $10,000 ($5,000 if your filing status is married filing jointly) for state and local taxes, including income, sales, and property taxes.

Taxpayers who itemize their deductions can deduct state income taxes on their federal tax returns. The states with the lowest income tax rates are a mix of flat tax and graduated tax rates: North Dakota (2.9% top marginal tax rate), Pennsylvania (3.07% flat tax rate), and Indiana (3.23% flat tax rate).

The states with the highest income tax rates all have graduated tax rates: California (13.30% top marginal tax rate), Hawaii (11% top marginal tax rate), New Jersey (10.75% top marginal tax rate).

0 kommentar(er)

0 kommentar(er)